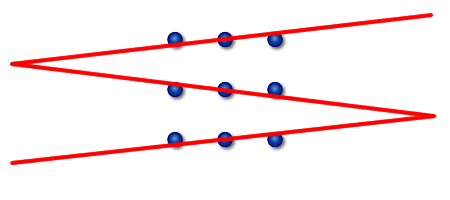

You’ll have no problem finding a solution with five lines, but in the unlikely event that you’ve never seen this puzzle before, four lines might prove to be a struggle. No tricks are needed, no folding the paper and no using an ultra-fat pen. There are nine dots arranged in a square, and your challenge is to join all the dots using only four straight line strokes of a pen, and with your pen never leaving the paper. Dog leads, mirrors and Hermann Minkowski.Significant figures: David Singmaster (1938–2023).Do the shuffle: finding π in your playlists.Penguins: the emperors of fluid dynamics.Chalkdust issue 14 – Coming 22 November.“I have never had a constituent say, ‘Gosh, I wish I could have more audits,’” Graves said. Garret Graves, R-La., lauded the Republican effort. “That is certainly an area over the weeks and months ahead that I’m going to be following up on.”Īrguing for the IRS cuts shortly before the House vote Wednesday night, Rep. “I’m very concerned that some of these cuts could impact the direction the IRS wants to go, and that is bring more fairness when you talk about audits,” Boyle said. The IRS’s enforcement staff has shrunk by about one-third since 2010, and Boyle said that has led to lower-income and minority taxpayers being audited at a higher percentage than the wealthy. Brendan Boyle, the top Democrat on the House Budget Committee, said former President Donald Trump’s own appointed IRS commissioner repeatedly brought up to Congress the dramatic staffing shortages the agency was experiencing. The CBO’s projections did not include the $20 billion that the White House agreed to divert to other programs. “CBO anticipates that rescinding those funds would result in fewer enforcement actions over the next decade and in a reduction in revenue collections,” states the May 30 report to Speaker Kevin McCarthy, R-Calif. The Congressional Budget Office has projected that the $1.4 billion rescission will actually increase deficits by about $900 million over the next decade because it will lead to less tax revenue coming in. Neal said he believes the IRS won’t be greatly harmed as a result of the cuts, adding, “That’s what I’ve been assured.” “The fact that the money is going to be diverted to other initiatives is not my first choice, but I think to get this over the goal line, in terms of the contrast of an international calamity, that has to be done,” he said.

He said the potential for a default was a far greater concern, so he understood why the White House agreed to the cuts. Richard Neal of Massachusetts, the top Democrat on the House Ways and Means Committee, said he spoke with the Treasury about the impact of the debt limit bill’s IRS funding cuts: “I came away, if not happy, at least satisfied.” “I don’t know if this will come out of service, enforcement, technology or otherwise.” It just may take a while longer” to develop certain promised programs, he said. “With less money and resources, everything will slow down. Steve Rosenthal, senior fellow at the Urban-Brookings Tax Policy Center, said “the loss of the funds has to be a setback” for the agency.

#Nine dots 4 lines free#

Treasury officials say their plan to develop an online free file tax return system, which is in its pilot development stage, for instance, will not be impacted by the cuts.īut some analysts are skeptical about the Biden administration’s assurances. Now, with some of that money clawed back, there is a question about what programs may take a back seat. The plan lays out the specifics of how the IRS would allocate the $80 billion through fiscal year 2031. In April, IRS leaders released details on how the agency would use the $80 billion infusion for improved operations, pledging to invest in new technology, hire more customer service representatives and expand its ability to audit high-wealth taxpayers. “In the appropriations process, we’ll come back for more.” “We have a down payment in this bill of $1.4 billion to rescind their enforcement hiring this fiscal year,” McHenry said.

0 kommentar(er)

0 kommentar(er)